RTDs or Ready to Drink meal replacement shakes are the most convenient form of food. No need to prepare anything, no need to clean you shaker, no need to worry about measuring. Just “Grab N’ Go”. However, choosing which is the best ready-to-drink meal replacement is not as easy.

RTD meal replacement shakes have a few issues:

- They tend to be more expensive

- Nutritionally less well-rounded

- Limited options

However, there are multiple benefits, as well:

- Healthy meal on-the-go

- Convenient

- Prevents you from eating crap

- Better texture

- Tastier

Taking all this into consideration, I have compiled my top picks for the best meal replacement drinks to make your life easier. So you can have the healthiest RTDs that actually make you feel good.

I apologize in advance for the heavy cacao/chocolate bias.

Latestfuel’s Top 3 RTDs

- YFood

- Soy Free, NoGMO

- Only in Europe

-

- Huel RTD

- Vegan, NoGMO, No Soy

- World

-

- Soylent Drink

- Vegan

- US & UK

-

How to Find Your Ideal Ready-to-Drink

Before you look into the top ready-to-drink meal replacement shakes, there are a few things you should notice.

- Not all RTDs will be available everywhere.

- Are you looking for a vegan ready-to-drink meal replacement?

- What is your budget?

To my first point, the meal replacement shake offering is usually better in Europe and in the UK. For instance, YFood is only available there, and it’s my favorite RTD. However, there are plenty of good options in the US, like Solent Drink or Huel.

Luckily, there are plenty of vegan ready-to-drink meal replacement shakes, and in fact, the majority of RTDs will be vegan-friendly. I have stated which is and which isn’t in my picks, though.

Finally, it’s worth mentioning that if you are very budget focus, you might be better off looking at meal replacement powders. RTDs start at about $3/serving (400kcal) while powder meal replacements can cost as little as $1.5.

Best RTD in the US

Soylent Drink - Huel v2.0

- Mana

- OWYN

Honorable mention goes to Plenny Drink from Jimmyjoy. I have not listed it below, but it is a good alternative from $3.25/400kcal. The reasons why I have not included Plenny drink are the fact that is often unavailable (they ship from Europe).

Best RTD in Europe (Including UK)

The choices for ready-to-drink meal replacements in Europe are much more varied. For instance, my favorite RTD, YFood, is only available here.

- YFood

- Huel v2.0

- Mana

- Plenny Drink

- Feed

Best Vegan RTDs

From a nutritional standpoint, all these shakes are vegan, excluding YFood, which contains milk. It’s worth noting that YFood does offer a vegan alternative, but in my experience, they don’t taste as good as the milk-based ones.

- Soylent Drink

- Huel v2.0

- Mana Drink

Besides, Huel and YFood are soy free, and perhaps the most different when looking at the ingredient list.

Without further ado, let’s dive into my top ready-to-drink meal replacements.

The Very Best Ready-to-Drink Meal Replacement Shakes

1. YFood Original

Best Tasting

| Taste | 95% |

| Texture | 95% |

| Nutrition | 75% |

| Price | 80% |

| Overall | 85% |

Pros

- The best-tasting RTDs

- Tons of delicious flavors

- Superb Limited editions

- 33g of protein per shake

- Also available for vegans

- Available EU & UK

Cons

- Vegan shakes are worse

- High in natural sugars – lactose

YFood is my favorite RTD brand, and has, in my opinion, the best chocolate ready-to-drink shake on the market.

Unfortunately, this is only available in Europe, so if you are from the US, you will have to stick to Huel or Soylent.

Furthermore, YFood is one of the only brands offering a milk-based and a plant-based RTD. While most are vegan and based on soy protein; YFood uses lactose-free milk as a base.

Consequently, the taste profile is slightly different, with similarities to dairy milkshakes. This is one of the reasons, why I prefer YFood to the others.

On top of being special, YFood is also very competitive in price; with some of the most affordable shakes in Europe.

Plus, YFood is also the brand with the most flavors available. Coconut, Salted Caramel, Chocolate, Coffee, and even special editions like Mango Lassi (absolutely incredible) are among YFood’s RTD lineup.

Finally, it is worth noting that YFood has the highest amount of protein per calorie in any RTD. Each 500ml will offer you 33g of top-quality protein.

Key Facts

- Macros (C/P/F): 31/28/41

- Serving Size: 500kcal

- Protein (g): 34g – Milk protein | Vegan RTD is also available

- Sugars (g): 22g – from milk

- Allergens: Milk (but it’s lactose-free)

- Flavours: Chocolate, Coffee, Salted Caramel, Coconut, Heavenly Hazelnut, Vanilla, Berry, and Banana.

- Best Flavour: Chocolate or Mango Lassi

| Vegan | Y* |

| Gluten-free | Y |

| Keto | N |

| Soy-free | Y* |

| Artificial Sweeteners | Y |

2. Soylent Drink Cacao

Best US

| Taste | 90% |

| Texture | 90% |

| Nutrition | 75% |

| Price | 80% |

| Overall | 84% |

Pros

- Good array of flavors

- Most of them are delicious

- Only 1g of sugar

- Variety Pack to try them all

- Soylent Cafe with caffeine

Cons

- US-only

- Includes GMO

Soylent’s RTDs are the real deal; the ones that started all, and have been hugely successful in the US.

They are not only they are the first, but also some of the most well-known. Soylent’s ready-to-drink shakes stand out for their taste and convenience.

In fact, in the US, you can get Soylent on the site (better for regular purchases) and at the stores (7-Eleven, Costco, Walmart….), which makes for a very handy meal.

Nutritionally, Soylent gives you all the essential nutrient your body needs following the US nutritional guidelines.

They have two lines of RTDs; Soylent Drink and Soylent Cafe. The names are self-explanatory, but besides the caffeine, there are no differences. Personally, I enjoy having Soylent Drink Original, which is a creamy vanilla shake that never gets tiring.

However, I truly enjoy Cacao and Cafe Mocha, too. Thus, the best way to start with Soylent is the Variety Pack.

Lastly, it’s worth noting that Soylent is the cheapest ready-to-drink meal replacement shake in the US. So a great bang for the buck, if you ask me.

Key Facts

- Macros (C/P/F): 35/19/46

- Serving Size: 400kcal

- Protein (g): 20g – from soy protein isolate

- Sugars (g): 1.0g

- Allergens: Soy

- Flavors: Original, Vanilla, Chocolate, Mint Chocolate, Banana, Strawberry, Chai, and Cafe Latte.

- Best Flavor: Original

| Vegan | Y |

| Gluten-free | Y |

| Keto | N |

| Soy-free | N |

| Artificial Sweeteners | Y |

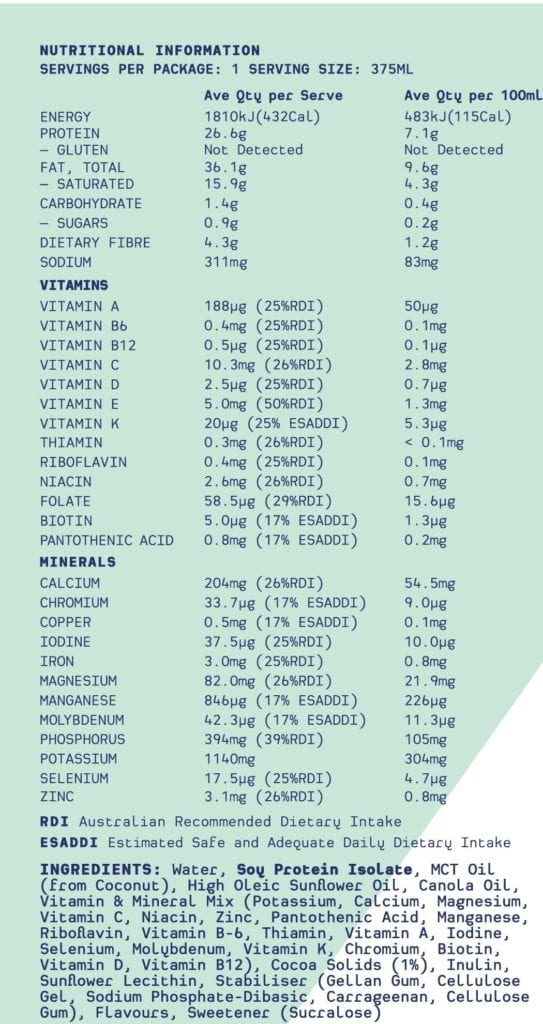

3. Huel Ready-to-Drink v2.0

| Taste | 90% |

| Texture | 90% |

| Nutrition | 75% |

| Price | 80% |

| Overall | 85% |

Pros

- Vegan, soy-free, no artificial sweeteners

- Super tasty

- Variety Box allows you to try all flavors

- Well-priced in the UK

- Available US, UK, EU

Cons

- Don’t buy v1.0

- Can be too sweet for some

When Huel initially launched their RTD, I was very disappointed. However, after the latest change to their formula (v2.0), it’s been a 180. I think that now they have one of the best vegan ready-to-drink meal replacement shakes on the market.

What’s even better, it’s available worldwide, so you can buy it in the US, UK, Europe or wherever you are. Note that the names of the flavors and the price might vary slightly depending on the country you reside. In fact, I think that the best deals are in the UK.

That aside, Huel Ready-to-Drink is one of the nutritionally most well-balanced RTDs. It’s a good blend of protein with all essential amino acids, healthy fats, complex carbohydrates, and 20% of your daily vitamins and minerals.

On top of that, their new formula is both gluten-free and free of artificial sweeteners, which is quite unusual.

Key Facts

- Macros (C/P/F): 37/22/41

- Serving size: 400kcal

- Protein (g): 22g – Pea protein and hemp protein

- Sugars (g): 2g – from coconut sugar

- Allergens:

- Flavors: Ice Coffee Caramel, Salted Caramel, Cinnamon Swirl, and Strawberries and Cream.

- Best Flavor: Ice Coffee Caramel or Salted Caramel

| Vegan | Y |

| Gluten-free | Y |

| Keto | N |

| Soy-free | Y |

| Artificial Sweeteners | N |

4. Orgain All-in-One

| Taste | 80% |

| Texture | 85% |

| Nutrition | 80% |

| Price | 80% |

| Overall | 81% |

Pros

- Organic certified by USDA

- Gluten-free, soy-free

- 16g of protein per serving

- Includes antioxidants and greens

- Plant-based and whey-based versions

Cons

- Limited flavors

- Only in the US

Even rarer are organic ready-to-drink meal replacement shakes. Luckily, Orgain has just what you are looking for.

Orgain’s All-in-One Nutritional drink might not be the tastiest drink on this list, but it provides you with quality organic greens and vegetables. As such, it will boost your immune system, and help you both mentally and physically.

I also like the fact that you can buy both vegan and whey-based versions. Having tried both, I believe that the whey-based is better, since the texture on the vegan ones is a little off.

Key Facts

- Macros (C/P/F): 47/21/32

- Kcal: 250kcal

- Protein (g): 16g – from organic pea protein, organic chia seeds

- Sugars (g): 11.0g

- Allergens:

- Flavors: Creamy Chocolate Fudge, Sweet Vanilla Bean, Iced Cafe Mocha, and Strawberries.

- Best Flavour: Creamy Chocolate

| Vegan | Y |

| Gluten-free | Y |

| Keto | N |

| Soy-free | Y |

| Artificial Sweeteners | N |

5. Mana Drink

| Taste | 85% |

| Texture | 90% |

| Nutrition | 80% |

| Price | 75% |

| Overall | 85% |

Pros

- Best for daily use (Origin)

- Science-based

- Most comprehensive protein profile

- Easy to carry around

- US, EU and UK

Cons

- 3 flavors only

- Contains soy

ManaDrink is a Czech company that makes science-based meal replacement shakes. Their RTD is among the best RTD shakes I have due to its nutritional input and taste.

Their RTD contains 42 essential nutrients with over 170 health benefits. Some of the most notorious aspects are the omega-3 profile – among the best- and the protein profile (with 6 different sources). You can be sure that you won’t lack any nutrient with Mana.

However, what makes Mana Drink stand out, similarly to Soylent, is their Origin flavor. Once again, it’s a more neutral creamy flavor that never gets tiring.

You are able to purchase Mana in Europe, UK and in the US. You will find that the website is packed with nutritional information and lab analysis, proving the quality of their products.

Have a look now!

Key Facts

- Macros (C/P/F): 35/21/44

- Serving size: 330kcal

- Protein (g): 16g – soy isolate, pea protein isolate, oat protein, hemp protein, brown rice protein, algae protein

- Sugars (g): 6.5g

- Allergens: Soy

- Flavors: Original, Chocolate, and Apricot

- Best Flavou: Origin

| Vegan | Y |

| Gluten-free | Y |

| Keto | N |

| Soy-free | N |

| Artificial Sweeteners | Y |

What If I Live Outside US and EU?

For most regions besides these two, it will be hard to find suitable alternatives. Even in Canada, you will not be able to purchase most of the RTDs mentioned above (Soylent, Huel, Saturo) due to the governmental restrictions.

Some of these brands, namely, Huel and Jimmyjoy (not included), do offer worldwide shipping. Despite this, because they use weight as a factor to estimate the shipping, it will be really expensive.

The shining star in the darkness is Aussilent. This Australian brand has 2 different ready to drink products, with one low-carb option (Ketoish) and one more similar to Soylent (but still more fat).

An Overview to RTD Market

North America

Ready to drink meal replacements have been around the US for a while, since Soylent launched Soylent Drink Original back in September 2015. They followed up with more flavours, namely, Cacao, Nectar (12/16), Strawberry (06/18) and recently Vanilla (09/18). Plus, Soylent Cafe (the caffeinated version) in August 2016, expanding the flavour options in June 2017 (Cafe Vanilla and Cafe Chai).

In July 2017, Soylent was available in 7-Eleven shops, which was a great jump forward on the introduction of complete foods to the general audience. Now, you can find them in other stores like Kroger, Walmart or Target; besides over 8,000 7-Elevens.

So, Yes a Lot of Soylent, but What About Other Soylent Alternatives?

Currently, there are 4 brands offering RTDs in the US: Huel, Soylent, Jimmyjoy (Plenny Drink) and Saturo. However, in this fall ManaDrink (a Central European giant) will join them in the US.

Sadly, Saturo, Mana and Soylent are very similar to each other in ingredients and macronutrient distribution. While they all offer something unique, I think Soylent still comes ahead.

Europe

The RTD market in Europe is at the most competitive it has ever been. Mana Drink was launched at the start of 2017. Closely followed by the Austrian RTD one-trick Saturo, which has become one of the biggest names in the market and is now already to jump to the US.

Later on, YFood brought a non-soy based RTD (my top pick). More recently, there has been other brands like Huel, Feed. or Trinkkost jumping on the RTD hype train.

Oh, and let’s not forget. Soylent is also fight for a piece of the pie in Europe, after they launched their products via Amazon in the UK.

RTDs in the World

| RTDs in the World | ||||||

| Company | Price | Ships To | Profile | C | P | F |

| Soylent | $$$ | US&UK | V,GF | 38 | 19 | 43 |

| YFood | $$$ | EU | NG,GF | 31 | 28 | 41 |

| Saturo | $$ | EU&US | V,NG,GF | 35 | 20 | 44 |

| Feed. | $$$ | EU | V,NG,GF | 52 | 15 | 33 |

| Runtime | $$$ | EU | 38 | 29 | 33 | |

| Sated | $$$$ | World | V,K | 8 | 17 | 75 |

| Plenny Drink | $$ | EU&US | V,NG | 54 | 13 | 33 |

| Jake Drink* | $$$ | EU | V,NG | 34 | 23 | 43 |

| Huel RTD | $$$$ | EU&US | V,NG,SF | 38 | 20 | 42 |

| Ample | $$$$ | US | V,K*, NG | 25 | 27 | 50 |

| Mana | $$$ | EU&US | V,NG | 35 | 20 | 44 |

| Trinkkost | $$$$ | EU | V,NG | 43 | 26 | 31 |

| Appetite | $$$$ | BEL | – | – | – | – |

| VitalHouse | $$$ | NA | V, NG, GF | 40 | 29 | 31 |

- GF– Gluten Free.

- V– Vegan.

- NG– Non-GMO.

- K– Keto.

- LF– Lactose free but not Vegan.

- SF– Soy Free.

Why Are RTDs So Popular Now?

First and foremost, it is important to remark that the meal replacement market is in its infancy right now. Much of the potential audience has not been introduced to complete foods and thus there is a huge piece of the pie yet to be tasted.

Thus, the companies are attempting different marketing techniques, as well as, producing various types of products, in order to find the key to the general population.

As such, they are trying to come up with the “perfect” product that will solve some of the issues the market presents (selling in retail, overcoming competition, convenience, price…) for both new and old consumers. RTDs have many advantages in this regard.

Furthermore, after seeing how Soylent made a bet on their RTD over the powder version and endeed up succeeding; it is normal that the European counterparts have tried to emulate it. Soylent achieved controll the US market and ensured retail deals with some of the biggest retailers in NA with Soylent Drink.

Ready-to-drink vs Powder

There are also other key factors that make RTDs more appealing to the consumers and the brands.

Benefits of RTDs

- Convenience. Let’s start with the most obvious one. RTDs are far more convenient than powders, particularly if you are to drink them on the go. It is not only that, but there is also the accountability factor. RTDs do not require use of scoops or any measurements. You know what you are getting in each drink, and that is a big load off some people.

- Portability. Tied with the last point, it is obvious that RTDs are more portable than the powders. You do not need to bring a shaker, a pouch and/or water. You can take them almost anywhere (except plains) and drink them in an instant.

- Time. Meal replacements are partially about saving time. There is not a quicker meal than the one already prepared for you in a bottle. Just open and drink.

- Stigma. Complete foods have a certain stigma. “They are not real food”. “They are unhealthy”. “They are weird”. Some people are put-off by shakers, powders and the preparation. However, the same people will likely buy a smoothie in the supermarket or even a protein shake. Just because they do not see the preparation method and these two are more accepted in the society.

- Easier to sell in retail. Partially linked with the last reason I gave, RTD products will be more easily sold in retail. Think about it. Are you more likely to buy protein powder or a protein shake in the supermarket. There are a lot of factors that influence this decision in the consumer, but familiarity is one. I feel that currently customers are more familiar and comfortable with nutritional drinks than are with nutritional powders (the second just does not seem natural).

- Easier for people to start with. Maybe a follow up of the last point, RTDs are easier to start with (if sold on retail). You can easily only buy one and it is not a big commitment (maybe a €2-4 commitment). If you see them close to the usual protein shake you buy, you might think “why not?”.

- Easier to buy. If they are in fact, expanded to real world stores (not online), like Soylent in US and Saturo in Austria, they are easier to buy. Not only because they are easier to compartmentalize in a store than powder (think about all the types of store that sell some kind of drinks over powdered food), but also because as said before they require less commitment and not preparation at all. Just buy and drink.

- Consistency and taste. This one is subjective and personal, but RTD shakes are blended with industrial blenders, which creates smoother and better mixed shakes.

What Are the Downsides to RTDs?

- Price. All RTD products are more expensive. Soylent Drink for instance is almost $2 more expensive than the powder version. This is due to many factors, including the processing cost, the shipping costs, the packaging… So, currently, if you are on a budget or likely to consume your meals at home, powder versions are far superior.

- Production and shipping cost. It is basically the reason why the price tag is so much higher than the powder versions.

- Shelf life. One of the issues with mixing the powder with water is that reduces the shelf life of the powder.

- Preservatives. Some companies will have to add preservative to make longer shelf lives possible. This will change the formula, perhaps the taste and will go against the company policies of adding chemicals.

- Environmentally less friendly. Let’s face it, RTDs require more production cost, they are more expensive (both economically and environmentally) to recycle, they have a bigger transportation cost (volume and weight) and require more materials to produce.

- More storage. For a lot of us, Europeans, this is an issue; since we live in “tiny” flats. Also, many of the potential consumers (office workers in big cities), they will have limited space in their houses. Having a 30 days worth of RTDs at home requires significant space, that powder simply does not.

RTDs Vs Meal Replacement Bars

The other alternative for portable meal replacements is bars. Bars are not as common as RTD products, but have quite a following in Europe. Thus, they are more commonly found in European brands. But why would you choose RTDs over bars?

Benefits of RTDs

Regarding how RTDs fair vs bars, the first tend to be nutritionally more complete and balanced. This is due to the fact that bars need to deal with solidifying fats and other manufacturing issues.

On top of that, RTDs have more flavour options and are easier to tweak to different nutritional values. RTDs also offer hydration, while the bars would require a bottle of water or hydration method of choice.

Benefits of Bars

On the other hand, bars require less space, less volume to transport and perhaps are more discrete. They also have a smaller wrapping, which at first glance should mean more environmentally friendly; however, this wrappings are not as widely (easily) recycled as the bottles are.

Besides, meal replacement bars allow you to chew, which is sometimes appreciated when you are mostly on a liquid diet.

Are RTDs Environmentally Sustainable?

One fact that no one can hide is that they create significantly more waste than the powder meal replacements. Plastic bottles might be recyclable, but not only they require energy, water and an industrial process to do so; but also often are simply not recycled. Less than half of the bottles in 2016 were recycled and only 7% become new bottles as cited by The Guardian.

Many just end up on the sea. So many in fact, that a report by Ellen MacArtur estimates that there will be more bottles than fish in our oceans by 2050. So, if we are such an environmentally friendly industry, are we going to promote this trend?

How do Companies Approach This Issue?

For most companies, it is complicated, since RTDs have huge economic potential and could be key to open them to a new market. Thus, they need to juggle between their core believes and the need for profit.

Let me put an example. Huel’s core beliefs are “being supported by experts”, “being affordable”, “zero food waste mimimal total waste”, “high manufacturing standards”, “being ethical” and “being environmentally friendly”.

RTDs are not as “affordable”, nor are “minimal waste”, nor are the most environmentally friendly products. Even less, if we consider many plastic do not end up being recycled.

Huel does try to act upon this by using 25% recycled plastic in the bottles; which are 100% recyclable. Not only that, but they promise to increase this number to 60%.

Biodegradable Bottles

Besides the approach of using recycled plastic, there is the possibility to use biodegradable materials when making bottles. Bertrand (an European organic brand) uses these bottles on the pre-powedered bottles.

However, while these work with powder they would not work with a ready-to-drink product; due to the fact that they let light pass. On top of that, they would not meet the criteria that would keep the shake in good condition.

Thus, as for now, this is not a viable avenue.

RTDs vs “Normal” Food

One of the arguments that needs to be taken into consideration is that RTDs are still more environmentally friendly than most ready-to-eat meals. These are often wrapped by multiple layers of protection, some of which hard to recycle.

Thus, it is true that RTDs can cause less impact than “normal food” and could still help in the bigger picture. All as long as the customer also collaborates by recycling.

Are RTDs the Future of Meal Replacements?

One of the most clear things is that RTDs are here to stay.

Are They Going to Become the Most Prominent Way to Consume Meal Replacement Shakes?

My guess, based on the protein shake industry, is no. The price difference is too important for most consumers (and definitely for the current audience) to make up for the convenience and portability. Most people will stick to the budget and “meal prep”.

Besides, powder meal replacements offer logistical, economical and ecological advantages previously discussed that I do not think RTDs will overcome anytime soon.

Are RTDs They Key to Open the Meal Replacement Industry to the Masses?

No. I think that will be a longer and more complicated process, where many other factors (marketing, health organizations backing up, time, familiarization with the concept) will have part.

It is, however, a way to start introducing the concept and de-alienize it. A way to let people know that this products are here and are safe for the average Joe. That they are not special shakes for dieting, or people that are ill or those who care “too much” about their health.

Are We Going to See More Ready-To-Drink Products from Other Brands?

There is no doubt about it. For instance, I am eager to see Sated’s first in Keto RTD in the world. I think that the offer right now is too similar and that there are way too many opportunities to miss.

However, the expansion of new RTD products is currently gated by the size of the market and huge initial cost of producing them. No brand has the facilities to manufacture them, thus they rely on 3rd party factories that take order by the 10,000s.

Define the Future Industry

However, it is true that now could be a turning point in the meal replacement industry. If RTDs are a huge success, and both old and new customers embrace this kind of product with more ferocity than predicted, they could become the most common way to consume complete foods.

As such, it is always good to remember that part of the industry was born as a more environmental friendly, less impactful way to consume food. Just because we can safe some time we should not forget our core values. Nor why some of us believe in meal replacements as a more sustainable alternative to “real food”.

Plastics are a huge problem in the current world, if we make a strong bet for RTDs, we are helping the issue instead of solving it.

FAQ

These are most of the RTDs available in Europe and North America. If you live outside these regions you will have trouble finding a suitable product. The exception being Aussilent’s RTD (Australia).

In my opinion, they are not as healthy as the powder, but will cause you no harm. The nutrients in the shakes are slightly more processed and less natural, but will still provide you with all you need in a daily basis.

In Europe, Saturo, Plenny Drink and YFood are the most affordable options. In the US, Soylent might be one of the better options, together with Plenny Drink.

RTDs have pros and cons. In general, have a much more pleasant drinking experience, due to the smoothness and taste. However, they are sweeter and more artificial. Nevertheless, the strongest point for RTDs is that they are convenient and you can have a proper meal anywhere, with minimal effort.

Yes, but I would advise against it. Among other things, because the ingredients tend to be more processed they lose nutrients and phytonutrients. Compounds like antioxidants are going to be more rare in these shakes.

Any of these picks can be used to lose weight when paired with calorie restriction and balanced lifestyle. These RTDs are superb at keeping you full and helping you to count calories while providing you a diverse set of nutrients.

Final Thoughts

I have covered many things in this best ready-to-drink meal replacement shakes selection, including topics perhaps beyond the scope of choosing the best RTD.

However, I think they are interesting to think about; particularly the environmental impact RTDs have or how they could be sold (like they are) in supermarkets.

As usual, I hope you have enjoyed my insight into the topic, and let me know what your favourite RTD is.

Sources

2. US Health Guidelines 2015-2020.

3. WHO Nutritional Guidelines.

4. EFSA Nutritional Guidelines.

5. More in: latestfuels.com/resources. A compilation with different governmental guidelines and references.

6. Ultimate Meal Replacement List. List with all the brands that deliver to the UK.