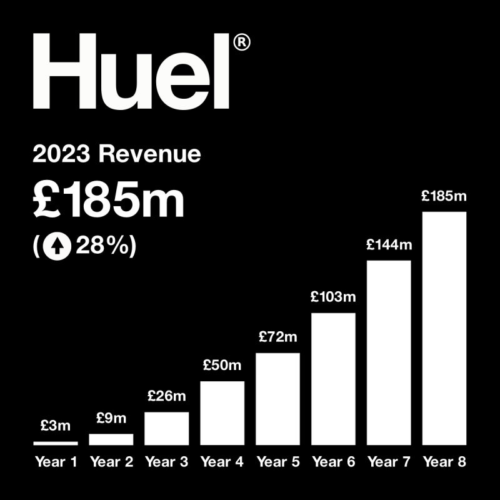

Huel’s Annual Revenue Reaches $200 Million – What’s Next?

A week ago, the British complete food company Huel proudly announced a 28% increased in revenue in 2023 to surpass the $200 million revenue milestone (£185M). This is a huge achievement for the plant-based meal replacement company that has also been accredited with B Corp certification earlier this year, and even secured an investment from Morgan Stanley.

In fact, 2023 has been an incredibly successful and busy year for Huel, which has transitioned from a complete food company to an all-around supplement company with the launch of their Huel Daily Greens and A-Z Vitamin Drink.

They have also further increased their presence in retail by 51%, and Huel products, mainly Huel RTDs, are now present in 11,520 stores.

In this piece, I would like to look back, assess where Huel is at, and look at the future of the leading company in the meal replacement industry.

Where Huel Comes From

Huel was founded in 2014 by Julian Hearn (now Chief Marketing Officer) with the collaboration of the nutritionist James Collier.

The initial idea was to create a convenient food that was healthy, but also good for the environment. Thus, Huel has always promoted a plant-based lifestyle and all Huel products are 100% vegan. Much of their focus has also been in reducing waste, using recycled materials, and promoting environmentalism.

To make nutritionally complete, convenient, affordable food, with minimal impact on animals and the environment.

Huel’s Mission Statement

The company started in Aylesbury, and has since moved to Tring. Their first product was Huel Powder, a fully plant-based meal replacement powder with heavy emphasis on protein. 37% of the energy was from carbohydrates, 30% from protein and 30% from fats, a macronutrient split that hasn’t changed since.

Huel Boom

Since the very beginning Huel was a huge success, grossing $10M in revenue in the second year. One of the biggest challenges that Huel faced early on was increasing their product and flavor range and expanding to markets outside the UK.

Initially, Huel only sold the Huel Powder, Granola (which was discontinued in 2020) and the Huel Bar, also known in the community as the brick. Whereas the opposition like Jimmyjoy (Joylent at the time), and Queal made an early bet for the European and even the American market, Huel remained UK only until 2016.

In 2016, Huel started delivering to Europe, and in 2017 it took the challenge of crossing the Atlantic.

Huel vs Soylent, The Battle for the USA

Huel’s main competitor at the time, and global market leader, was Soylent.

Soylent is a US-based brand founded by Rob Rhinehart in 2013 and started the complete food renaissance in the 2010s. Many European brands like Mana, Joylent, Queal and perhaps even Huel took inspiration in the success and sometimes the formula of Soylent.

The success of Soylent was immediate, as it was able to raise $1.5M via crowdfunding in Tilt. This was soon followed by $20M of Series A funding, and $50M later raised in 2017. In total, Soylent was able to fund over $113M from VC funds to support their growth.

Early on, Soylent had the name and the popularity on its side, a bigger subreddit (r/soylent) and people tend to use the word “lents” to refer to complete food drinks. Despite the European competition, Soylent had a hold of the US market, thanks to their powder and ready to drink products (Soylent Drink).

However, a series of wrong decisions, product recalls, unsuccessful releases, and management shake ups, Huel was able to take the majority of online meal replacement sales in the US. This growth was supported by the release of Huel Black in 2019, which has since become their best-selling product.

Consolidation & VC Funded Growth

Up until 2018, Huel had refused to take any external investment onboard. The company had been able to grow faster than every other competitor organically to a £200M valuation, and raised £20M in funding to expand their US and EU operations.

This funding was used to create Huel Black, launch the Huel Ready to Drink (as an alternative to Soylent Drink), and re-release the Huel Bars. Later on, Huel used this money to launch Huel Hot & Savory, their take to chewable complete foods, which was also a huge success.

Similarly, in 2021, Huel started expanding from meal replacements to protein products with the launch of the “world’s first complete protein powder” and “complete protein bar”. This was a move to leverage their customer based into the profitable business of vegan protein, and back their high protein products.

Simultaneously, Huel started to dive into retail in the UK, partnering initially with Sainsbury’s and then with other retailers like Holand & Barret, Tesco, Morrison’s, and WHSmith. Since 2019, they have slowly but surely expanded their retail presence, mostly selling Huel Ready to Drink bottles.

After their initial round, Huel has raised a $24M series B funding round in 2022, and in November 2023 they were able to secure $100M in funding from 1GT Climate Fund by Morgan Stanley Investment Management among others.

Huel’s Future Plans

During 2023, Huel has slowly but surely shifted their focus on the products that they release away from complete foods to a more supplement oriented products.

Earlier during the year, they released Huel Daily Greens, their green superfood blend with 147 health benefits (only in the US), followed by the A-Z Vitamin canned drink. These products steer away from the original core products, as even some of their staff stated that he wouldn’t recommend green powders:

I wouldn’t recommend green powders, no. The benefits and positive effects seen in studies are from whole fruits and vegetables which is why I’m saying you can’t compare them to Huel.

u/Dan_Huel on Huel Forums

As Huel expands their reach and product offering, they are also building a new facility in Milton Keynes (UK), which will enhance the production capacity and remove the need of co-packers. The manufactury is set to start producing Huel products in Summer 2024, with warehouse operations starting earlier in Q1. According to James McMaster (Huel CEO), the facility will focus on the production of Powder and Hot & Savory ranges for UK and EU customers.

Huel’s Next Product

Regarding what the next Huel product is going to be, there’s nothing clear as they recently launched their latest product, the Instant Noodles.

Looking at their portfolio, it’s likely going to be a health supplement rather than a meal replacement or a complete food, as they seem to cover every single possibility and growth seems limited in the market.

Therefore, something linked to protein or nootropics could be their next move.

Note: After writing this article, Huel’s next product was announced, the Huel Daily Superblend. This meal replacement shake is the healthiest option Huel has, with 87+ superfoods, and puts Huel as direct competitor to Ka’chava.

Is Huel Selling?

Huel’s CEO James McMaster recently stated that they were open to be bought. As Huel steered away from a London IPO, this is what the CEO had to say:

We’re very happy as we are now, being self-sufficient from funding, but we’ve also got investors and they invested quite a long time ago so at some stage there needs to be a realisation of that. So let’s see what happens, and if we get different knocks on the door, and how hard they are.

James McMaster, FT

Huel is finally profitable with pre-tax profits of £4.7M and it has healthy margins and a growing audience of plant-based meal replacement lovers.

Key People in Huel

Julian Hearn, Founder

Julian founded Huel in 2014, after selling his first company, Mash Up Media. Julian created Huel with the aim of creating something he was proud of and doing the right thing for the planet, staff, and customers. Julian emphasizes the importance of starting quickly, working hard, making customers happy, having a clear mission, creating a brand people love, and being adaptable to solve problems.

James Collier, Co-Founder

James Collier is a co-founder and Head of Nutrition at Huel. He has a background in nutrition and has played a key role in the development of Huel’s products, ensuring they meet nutritional guidelines and provide a balanced meal replacement option. He still shares he’s knowledge in nutrition via Substack and his Twitter.

James McMaster, CEO

James took over the CEO role in Huel in 2017, when Julian stepped down from the role. He’s a business graduate from the prestigious Warwick University (UK). He was quite young when he took the CEO role, but has proven his worth growing Huel exponentially since he took the role.

Steven Bartlett, Board Member

Steven Bartlett is the founder of Social Chain – a marketing company with a valuation of $300M-, and also the incredibly popular Dairy of a CEO. He joined Huel in 2021 as a board member after a podcast episode with Julian, and has since been one of the biggest public advocates of Huel.

Besides them, Huel now has almost 300 employees spread around the world, some of which have been in Huel almost since the start like Tim Urch, Product Marketing Manager.

Huel Stats and Facts at a Glance

Founder: Julian Hearn

Co-Founder: James Collier

Founded in: 2014

Headquarters: Tring, UK

US HQ: Brooklyn, NY, USA

Business type: Complete Food and Nutritional products manufacturer and seller.

Main Selling Avenue: Online.

Shipping to: Worldwide*. Main places: USA, UK, EU, Japan. Not available: Canada, Australia.

Revenue: $200M or $185M in 2023 (year 8).

Retail presence: 11,250 stores – mainly in the UK.

Organization

Current CEO: James McMaster

Current CMO: Julian Hearn

Current CFO: David Di Cello

Current COO: Ruvan Mendis

Current CTO: Ollie Scheers

Products and Meals Sold

Products Available: 10

Best Selling Product: Huel Black

Type of products: Meal replacement powders, meal replacement bars, ready to drink meal replacements, hot and savory meal replacement powder, protein powder, green superfood powder, and vitamin drink.

Nutritional foundation: 100% plant-based complete food without soy. Usually high in protein (where it applies).

Nutritional features: Vegan, low-sugar, lactose-free, gluten-free (depends), soy-free, non-gmo.

Price per meal: Starting from $1/400kcal meal. Usually around $1.5-$2 per 400kcal meal.

Meals sold (400kcal): Over 300M

Product Overview

| Product Name | Description | Launch Date | More Info |

|---|---|---|---|

| Huel Powder | Complete and balanced powdered meal replacement | 2015 | Read review |

| Huel Essential | Cheapest powder-based meal replacement | 2023 | Read review |

| Huel Black Edition | A low carb, ultra-high protein, gluten-free, artificial sweetener free powder-based meal replacement | 2019 | Read review |

| Huel Bar | A snack sized nutritionally complete meal replacement bar | 2016 | Read review |

| Huel Ready to Drink | A convenient ready to drink complete meal replacement | 2018 | Read review |

| Huel Hot & Savory | Instant hot meals with a balance of nutrients | 2020 | Read review |

| Huel Instant Noodles | Instant nutritionally complete noodles | 2023 | |

| Huel Greens | Greens superfood blend with added vitamins and minerals and 175 health benefits | 2023 | Read review |

| Huel Vitamin A-Z | Canned vitamin drink with a range of essential vitamins | 2023 | Read review |

| Huel eBook | Protein powder with all vitamins and minerals for those looking to increase protein intake | 2021 | Read review |

| Phased Out Products | |||

| Huel Granola | Nutritionally complete breakfast granola | 2018 | Out in 2020 |

| Huel Complete Protein Bar | Protein bar with all vitamins and minerals | 2021 | Out in 2023 |

Besides it’s worth considering that a few of these products have had major overhauls.

- Huel Powder is in its third iteration. The current formula is known as Huel v3.1.

- Huel RTD had a new branch added in December 2021, with a artificial sweetener free formula known as Huel RTD v2.0

- Huel Bars are now in their 4th iteration, after a new overhaul in November 2023.